Need to Repair Poor Credit? – You’re Not Alone

Having a poor credit score can not only make our financial situation seem hopeless – it can also wreak havoc on our mental health.

Poor credit history can make us feel anxious, stressed, fatigued, and even angry.

You may have found yourself in this position due to falling on hard times and missing payment deadlines.

It may be that you’ve simply been a little imprudent with your spending habits in the past.

You may have even been an unfortunate victim of credit fraud!

The first thing to know is that you shouldn’t feel guilty or shameful about having a poor credit score.

You are not alone!

In fact, according to Experian’s study, around 16% of Americans are said to have FICO® credit scores of only 300-579, which is classed as a “poor” credit rating.

A further 18% have a score of between 580-669, which is classed as a “fair” rating.

The good news is that there are actionable steps you can start today to get your credit score back on track.

As soon as you start to take control of your credit, you will start to feel a whole lot better, even if it takes some time to make a measurable impact.

This guide is going to walk you through, step-by-step, what you need to do to get your credit score back in the green.

What Having a Poor Credit Score Means for You

If you’ve searched and found this guide, then you probably already have a good idea of what a poor credit score can mean for your finances.

Essentially, to any prospective lender you are looking to borrow from, it can make you a risky proposition.

Lenders want to ensure that the money they lend is secure.

They want to ensure that they receive timely repayments to cover the loan and also the interest on top.

If you have a poor credit score then this can mean the following when it comes to applying for credit:-

Credit Cards

You are much more likely to be turned down for a credit card or charged higher interest rates. This may mean that you have to rely on payday loans with interests rates up to 700%+.

Mortgage

Interest rates on mortgages are likely to be higher. For example, for a mortgage on a property worth $300,000, a person with a FICO Score of 760 would pay 2.821%. A person with a FICO score of 620 would pay 4.410%.

Employment

In most states, employers are permitted to pull up your credit report when deciding whether to hire you. Whilst employers generally can’t see your credit score, with permission they can access credit information and make decisions based on your financial shrewdness.

Insurance

One of several factors insurance companies look at when calculating your insurance premium, is your credit score. Insurance companies consider your credit score reflects how risky you are likely to be to indemnify. Therefore, the poorer your score is, the higher your premiums are likely to be.

What Actually Is A Credit Score?

Essentially, your credit score is a figure lenders use to assess your creditworthiness.

The score used by 90% of lenders in the US is the FICO® score.

FICO stands for Fair, Isaac, and Company – a data analytics company based in San Jose, California.

There are other types of credit scores but FICO is generally regarded as the industry standard.

Your FICO® score is a points scale graded from 300 to 850 with a 300 score being the worst rating and an 850 score being the best.

Here’s a breakdown of the scores:-

| FICO® Score | Rating | What this means for you |

| Less than 580 | Poor | A score well below the US average meaning you are a risky proposition for lenders. |

| 580-669 | Fair | A score below the average in the US but you may still be approved for loans and credit by some lenders. |

| 670-739 | Good | A score near to or just above the US average. The majority of lenders will consider this a good score. |

| 740-799 | Very Good | A score above the US average. This score shows lenders you a reliable and creditworthy borrower. |

| 800+ | Exceptional | A score well above the US average. You will be classed as an exceptional and extremely creditworthy individual to any lender. |

Why Your FICO® Score Matters

As we’ve already touched on, your FICO® score matters because it’s the score that most lenders really care about and use.

Not too many years ago there wasn’t really an industry standard and this meant lenders used many different credit scores which often brought about inconsistent results.

FICO® has helped to standardize credit scoring so consumers and lenders know exactly where they’re at.

FICO® has helpfully set out why their score is so important compared to other credit scores on their website as summarized in this table:-

| FICO® Scores | Other Credit Scores |

|---|---|

| The standard for over 25 years. 90% of top lenders use FICO® Scores. | Can be significantly different than your FICO Scores |

| Makes lending decisions consistent, fast, and fair | Not consistently used in lending decisions, if at all |

| Gives you a better understanding of your credit and more confidence when you apply | Can cause you to under or overestimate your creditworthiness |

Ways To Get Your FICO® Credit Score For Free

Before you can improve your credit score, it’s important to know what it actually is.

If you’ve been turned down for credit recently, you might already have a good idea of what your credit score is.

If not, and you want to know, then there are a few options that you can use to get your score for free.

#1 Discover

Discover is a free service that gives you access to your score by simply completing an online form.

This is the easiest and fastest way to get your score.

Get Your Credit Score With Discover

1. Visit Discover’s website

2. Enter your name and email

3. Set your password

4. Provide your contact details including address

5. Provide your social security number

6. Answer some security questions

7. See your score

After you’ve completed the signup, you should get access to your FICO® score which will look something like this:-

The scorecard also gives you a list of key factors that have affected it so you can see where you’ve gone wrong (or right).

#2 Through Your Bank or Lender

Because FICO® is the industry leader, it means that they have partnered with a lot of banks and other lenders.

FICO® works with over 200 financial institutions so they can give their customers completely free access to their scores at the drop of a hat.

This is called FICO® Score Open Access and you can find a huge list of these institutions on FICO’s website here.

This list includes everything from banks, to credit card companies, right through to mortgage providers.

If your particular lender is listed then you can contact them or check out their app to see if they offer this service online.

#3 Through Your Car Dealership

If you’re looking to purchase a new car using an auto-loan or on finance, then the finance department at your local dealership can probably check your credit score for you and even print off a report for you to look at.

The best thing is you don’t even need to be buying a car – the dealership won’t know whether you are or not.

It’s therefore a fairly straightforward method of obtaining your credit score.

However, I still think using Discover to get your score is probably the most straightforward and fastest method.

How Your Credit Score is Affected

If you have obtained your score and it’s a poor one, then you’re going to want to know why that is.

If you don’t know what affects your score, then you are likely to struggle to repair it as chances are you’ll carry on making the same mistakes that led to a poor score in the first place.

Most people will understand the basics and will know that things like late or non-payment of credit card bills have a huge effect on their score.

However, there are actually 5 separate factors that affect your FICO® score in different ways and to varying degrees.

We’ll tackle each of the 5 factors in turn.

#1 Payment History – 35%

Lenders care a lot about reliability and your ability to pay on time. In fact, the main concern for any lender is “will I get this money, including interest, back”. A lender’s entire business model depends on their customers making timely repayments. If a lot of the lender’s customers default on their loans, their business cannot be sustained.

The likelihood of a borrower repaying their loan in the future can usually be determined fairly accurately by their past payment history, hence why this factor is so heavily weighted when calculating a person’s score. The key factors include:-

– Whether the person has consistently paid on time each time they’ve borrowed;

– If a person has made late payments, how late were they?;

– When, in time, any payments were missed. For example, someone who made a late payment 4 years ago will generally be seen as less risky when compared to someone who has missed payments in the last 6 months;

– Whether a person has any Court Judgments, bankruptcies, lawsuits or black listings against their name.

#2 Credit Utilization – 30%

This concerns how much of your available credit you actually use. FICO analyses the ratio of credit to debt when calculating this score. Someone who has a $20,000 credit card limit with $19k already utilized will generally look riskier than someone who has only used $5,000. In other words, if you’re constantly maxing out your credit limits, it suggests you are less responsible and are a riskier proposition.

#3 Length of History – 15%

It’s often hard to assess someone’s creditworthiness if they’ve only used credit for a short period. It’s quite difficult to assess how fiscally responsible someone is over, say, only 6 months as enough time hasn’t been allowed to pass to allow for a proper analysis. However, lengthy credit history is only going to help you provided it’s not littered with late or non-payments. Essentially, FICO is looking for a long history that has been consistently well managed.

#4 Types of Credit – 10%

FICO’s scoring also looks at the different types of credit you have; whether that’s a credit card, mortgage, or car loan, and likes to see that all of your loans are being managed responsibly.

That doesn’t mean you have to rush out and open up lots of different lines of credit to show how “credit diverse” you are. After all, this is only 10% of your score. Moreover, most people will have utilized a number of different types of credit in the past in any event.

#5 New Credit – 10%

The final factor FICO assesses is the number of new lines of credit you have opened recently. When you apply for credit most lenders do a “hard pull” which is an in-depth check of your credit history. This can cause a slight reduction in your score as the assumption is that if you’re applying to several different lenders at the same time or close together in time, then you may be in financial difficulty.

What Does FICO® Not Take Into Account?

- Whether you’re married or not

- Your race, creed, sexual orientation, national origin or color

- Your age

- Your salary

- Whether you’re in receipt of public assistance

- Your Occupation, employer or employment history

- Where you live

- Any participation in a credit counselling program

- Any information not found in your credit report

Whilst FICO doesn’t consider these things, it doesn’t mean some of them won’t be considered by a creditor or lender. It’s just they will not form part of your credit score.

For example, a lender is likely to take into consideration your employment history and income when you’re applying for a mortgage even though these factors are not reflected in your FICO® score.

Obtaining Your Credit Report for Free

Federal law dictates that you can gain access to your credit reports once per year from the three main credit bureaus in the US.

These are:

- Experian

- Equifax

- Trans Union

Here’s a step-by-step guide to obtaining your report:-

How to Get Your Free Credit Report

1. Visit Annualcreditreport.com

2. Enter your personal information – here you’ll need to supply your name, address, date of birth and social security number.

3. Request a report from one, two or all of the bureaus mentioned above (our advice is that you obtain all three).

4. Provide some security information. There are usually a number of questions you’ll need to answer for each report which are specific to you.

5. Save your reports to your desktop. This will make it easier to access and read them later.

Credit Score vs Credit Report

It’s important to remember that your credit score and credit report are different.

Sometimes people confuse or conflate the two when they are in fact two separate things.

As we have covered above, your credit score is a metric lenders use to assess your creditworthiness and it is calculated from the detailed information on your credit report.

Your credit report is a detailed report of your credit history and contains a comprehensive breakdown of things like your credit lines, credit inquiries, any late or nonpayments, debt that is overdue and bankruptcies.

This information is reported by your lenders to the three bureaus we have discussed above and the information is then used by FICO® to calculate your FICO® credit score.

Note:

You should note that your credit score does not appear on your credit report. Therefore, to start improving your credit, it’s important to obtain both your credit score and report as we’ve shown above.

Getting to Grips With Your Credit Report

Once you’ve downloaded a copy of your credit report, you’ll want to understand what’s on there.

This will help you get to grips with your credit history and flag up any inaccuracies with it.

Any inaccuracies can then be dealt with later and hopefully removed from your credit report (NB. we will come to this further on in the article).

As above, there are 3 different credit bureaus and each has their own report so it’s recommended that you obtain all 3 when attempting to repair your credit.

We say this because:

- Some of your credit information may not have been reported to all 3 bureaus

- Creditors don’t always send information to the bureaus at the same time which can mean one report is more up to date than the other

- If you have changed your name, for example when getting married, then you may have applied for a loan or credit under a different name which can lead to an inaccurate or fragmented report

Even though the information on your reports can sometimes differ, the categories of items are generally very similar.

We will use Experian as the example report in this article but the categories of entries on the other two reports from TransUnion and Equifax are more or less the same.

The reports contain the following information:

| Information | What is it? |

| Personal information | Here the report sets out your name, address, date of birth, geographical code, residence type, social security number, and spouse. |

| Account information | Here the report provides information about the various credit accounts or lines of credit you have opened and provides useful information like the type of credit, your payment history, terms of repayment, and the dates the credit ran from and to. |

| Credit inquiries | Here the report lists any inquiries creditors have made about your credit history. The inquiries on your credit report are known as hard inquiries and stay on your report for up to 2 years. |

| Collections | Here your report shows whether you have had any of your credit accounts referred to debt collection agencies for non-payment. These stay on your report for up to 7 years. |

| Public records | Here your report will show up any bankruptcies you have had. These stay on your report for 7 to 10 years depending on the type of bankruptcy. |

Now we’ve summarized the information on your report, we’ll look at each section in more detail.

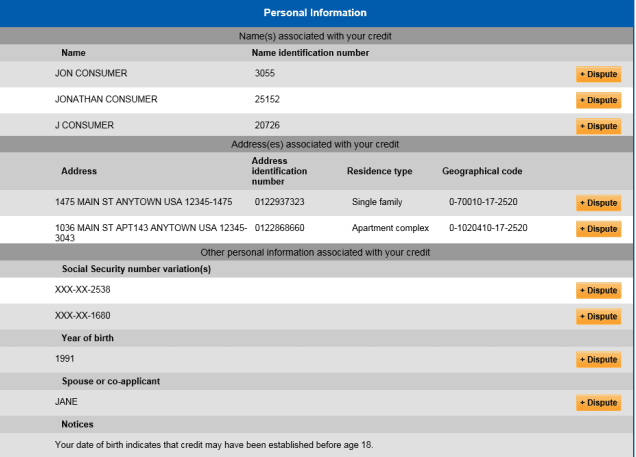

Personal Information

As we have summarized, the personal information section of your report will include all of the usual personal information you have provided when applying to lenders for credit.

Essentially, lenders then pass that information onto the various bureaus and it then appears on your report.

Here’s what this section should look like (this is from Experian’s sample report):

It’s important to check this section to ensure that all of the information is correct.

Note:

If you notice anything suspicious, this could be an indicator of credit fraud and you will want to raise this with your lender or the individual bureau.

However, before you panic, a mistake does not necessarily mean fraud.

For example, sometimes different variations of your name can appear if you have, say, used an abbreviated name when applying for credit or if the lender has filled in your details incorrectly.

If you need to update your details then you should contact your lender. You can also apply to the bureaus to do this but they may request documentary proof of the same.

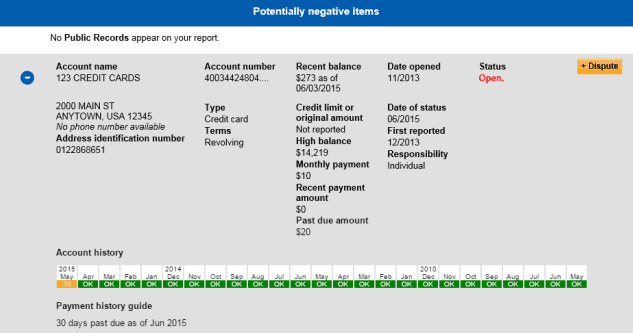

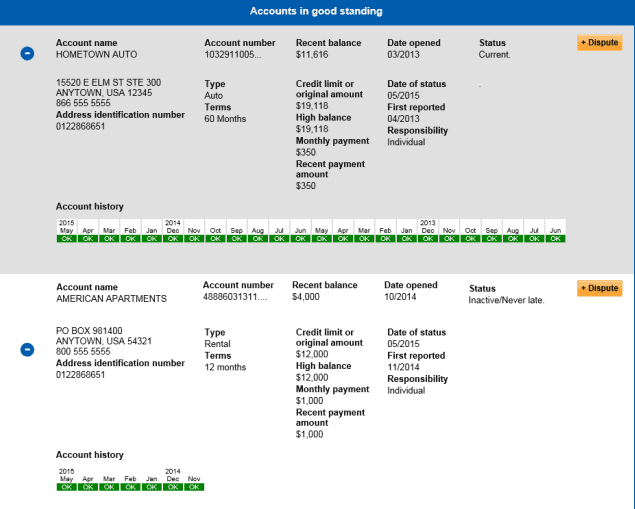

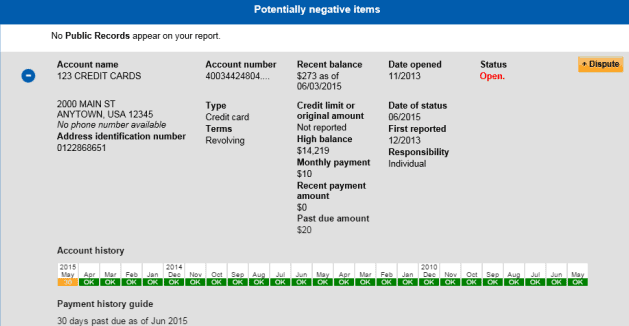

Account Information

The account information section of your credit report is probably the most important.

It provides a detailed history about each of your lines of credit and provides an account history that shows you whether there have been any late or non-payments.

Here on the sample report from Experian, you can see under “potentially negative items” there is a payment that is 30 days past due as of June that year.

As you can see, there is a button to dispute this negative entry if you believe it is incorrect (we will come onto this below).

You should also lookout for any accounts you do not recognize in this section. If there’s a line of credit you do not believe you’ve taken out, it could indicate fraud so it’s important to analyse this section carefully and to investigate if anything looks out of place.

You can also look for any “non-fraudulent” errors, like simple mistakes, and take them up with your lender or the bureau to have them corrected.

Here is the section of the report showing accounts in good standing. As you will note, the entire account history is in green with no late or non-payment flags.

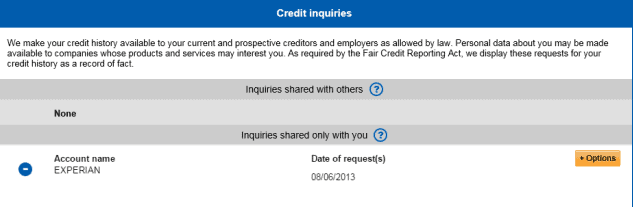

Credit Inquiries

The credit inquiries section of your credit report shows any instances where prospective lenders have pulled up your credit report, usually when you’ve applied to them for credit.

When a lender pulls up your credit report to check it, this is known as a hard inquiry and will appear on your credit report.

Each hard inquiry counts as a negative item and can lower your credit score by up to 5 points.

Hard inquiries stay on your credit report for up to 2 years but your FICO® score will only be affected for 12 months.

Unfortunately, hard inquiries can’t generally be removed unless they are a result of fraud like identity theft.

In most, non-fraudulent cases, you will just have to wait for the inquiry to drop off your report.

Here’s the credit inquiries section on the Experian sample report:-

Your credit report also shows “soft inquiries” (this is what is shown in the above sample).

These are generally when someone (including yourself) pulls up your credit report when you haven’t applied for credit. This might be when:-

- A current creditor pulls up your report

- You check your own report

- A lender checks to see if you are eligible for preapproval offers

- An employer pulls up your report

The important thing to remember is that soft inquiries do not affect your credit score whereas hard ones do.

Note:

Most lenders have a limit on the amount of hard inquiries they expect to see on your report. These limits vary but anymore than around 5 may make it difficult to get credit.

Collections

Your report will also show any collections that have affected your lines of credit.

Collections usually occur as a last resort when you have failed to make payments on your loan. It normally unfolds like this:-

- Your miss a payment on your loan

- Your lender gives you a grace period to pay the outstanding sum

- You fail to pay after the grace period and you are informed your account will be moved into collections

- The lender instructs a debt recovery agency or sells your debt to the agency

- The agency takes steps to recover the debt from you

A collection is a serious blemish on your credit report and will seriously affect your credit score.

Collections generally remain on your report for up to 7 years plus 180 days from when the sum became past due.

Moreover, collections are extremely difficult to remove from your report as we will come on to below.

Public Records

It used to be the case that there were three types of public record that could appear on your credit report including; bankruptcies, court judgments and tax liens.

However, the only public records that appear now are bankruptcies.

There are two different types of bankruptcy:-

- Chapter 13 bankruptcy where the debtor pays some of their debt. This stays on your report for 7 years.

- Chapter 7 bankruptcy where none of the debt is discharged. This stays on your reports for 10 years.

You can see the section for public records on the Experian sample report which shows this account has no public records listed.

Repairing Your Credit Score: Practical Steps

Now you know how to obtain your credit score and understand your credit report, we shall consider some practical steps you can start today to get your credit back on track.

There are several things you can do to start improving your score but the key thing to remember is that it takes time and patience.

Unfortunately, there is no magic bullet that will fix your credit score overnight.

However, the sooner you start to take action, the quicker you’ll see results.

#1 Disputing Items On Your Credit Report

Unfortunately, mistakes do happen when it comes to credit reporting and this could mean you are sitting on an inaccurate credit report.

Errors on your credit report can be a result of innocent mistakes like your lender providing the bureau with the wrong information.

Errors can also be due to more malevolent reasons like fraud or identity theft.

While not all errors will affect your credit score, some will and it’s therefore important that they are disputed.

Here’s a list of common errors you may find on your report:

- Inaccurate personal information such as your name, date of birth, address, phone number etc.. Whilst these are unlikely to affect your score – they are still worth correcting. The key here is to make sure your report does no contain someone else’s contact details;

- Inaccurate account information. This may include things like missed or late payment recording errors, closed accounts recorded as open and account limit or balance errors. Make sure you look out for any accounts you do not recognise as their presence on your report could be a sign of identity theft or fraudulent activity;

- Outdated entries. There are statutory time limits for items that are listed on your report. For example, late payments should remain on your report for a maximum of 7 years and should fall off after that time. Occasionally some of these items remain on your report despite the statutory time limit having past. It’s therefore important to check that any negative items on your report have not expired. If they have, they should not be on there and can be disputed.

Note:

When you get to this stage, it’s important to check all 3 credit reports as not all items are guaranteed to appear on each report.

Who Do I Report Disputed Credit Items To?

The Fair Credit Reporting Act dictates that both the credit bureaus and individual lenders/providers (i.e the people providing the information to the bureaus) are responsible for correcting any any inaccurate data on your credit report.

This means the first step to resolving any inaccurate credit reporting data is to write to the credit bureau in question.

Writing to the Credit Bureau

If there’s an error on your report, the first thing to do is to write to the bureau in question and to include a copy of your credit report with items you are disputing marked on there.

You should also include copies of any evidence that you have to prove that your report contains errors.

This could be things like:

- Proof of address or other personal information (if you’re disputing the accuracy of this information)

- A letter from the lender in question if they’ve confirmed an error

- If disputing a late or non-payment, evidence showing when you paid like bank statements or receipts/invoices

- A letter from the police if you’ve been the victim of fraud

Ensure that you only send copies of this documentation and not originals and that you keep separate identical copies of all the documents you’ve submitted.

You can draft your own letter to the bureau but we recommend using the Federal Trade Commission’s template which can be found here which will save you time and ensure you don’t include anything that’s not required.

After you have submitted your letter and accompanying evidence, the bureau in question will raise your dispute with the provider (usually the lender) that provided the inaccurate information to them.

The provider then investigates and should provide a response to the bureau and to you within 30 days.

If the provider accepts an error has occurred then they are obliged to notify each of the 3 bureaus so your report with each can be corrected.

The bureau will then write to you to confirm the results of your dispute and will provide a free credit report if a change has been made.

If an item is inaccurate then the bureau is obliged to delete it or change it and the same should not reappear on your credit report unless the provider presents new evidence.

You should note that if changes have been made, you can ask the bureau to notify anyone that has requested your report in the previous 6 months.

If your dispute is unsuccessful you can still ask your credit report to be marked by the bureau to show that you have disputed information contained on it.

Here are the addresses to send your dispute to:-

Experian Address

P.O. Box 4500

Allen, TX 75013

TransUnion Address

P.O. Box 2000

Chester, PA 19016-2000

Equifax Address

P.O. Box 740256

Atlanta, GA 30374-0256

Writing to the Lender/Provider

If your dispute with the bureau is unsuccessful then you can try writing directly to your lender or whoever has provided the incorrect information to the bureau.

The process is similar to when you write to the bureau in that you should provide a copy of your credit report with the disputed items marked on it. You should also provide copies of any evidence in support.

Remember to keep copies of everything you submit.

Again, the FTC has provided a handy template letter you can use when you write to the lender.

The lender/provider should investigate your dispute within 30 days and if you are successful then they must inform the bureau so they can update or delete the inaccurate items.

What you are hoping for is that the lender/provider is unable to rebut your dispute and the item in question has to be removed or amended.

Obviously, this won’t always happen and you will need good evidence to be successful but it’s definitely worth trying if you have a good cause.

If the lender/provider doesn’t uphold your dispute and remove/correct the item, they must still inform the bureau that you have disputed it and you can ask that a note is put on your credit report.

#2 Improve Your Payment History

As we identified above, the most important part of your credit score is your payment history (35%) so the obvious place to start is here.

Late and missed payments can cause havoc with your credit score so the sooner you start to become more consistent and reliable with your repayments, the better things will get.

Your credit score is affected more severely if you have a lot of recent missed or late payments.

This means that you can help your score by ensuring your more recent credit history is in good health, ideally with no missed or late payments.

Easy said than done, right?

Well, there are actually a few strategies you can follow to do this and we’ll take a look at some here:

Start a Side Hustle

The obvious reason why people fall behind on their credit payments is they simply fall on hard times and can no longer afford to pay off their debt.

Whilst it can be very difficult to plan for unexpected events like being made redundant or falling ill and being unable to work, having an additional revenue stream can offer a safety net.

There are now literally hundreds of side hustles you can do online from home to start making more money.

Better still, a lot of them can be done without having to requalify or learn specialist skills.

Here are a few ideas:-

- Do freelance writing or other gigs through services like Fivver

- Take surveys

- Sell some unused or old goods on places like eBay or Craig’s list

- Do freelance proofreading

- Set up a blog

- Try affiliate marketing

- Do microtasks with services like TaskRabbit

- Rent out a spare room with Airbnb

Learn How to Budget and Save

The problem with most Americans is that we tend to spend way above our means when a slightly more sensible and level-headed approach to our finances can easily be achieved without feeling like we’re sacrificing our enjoyment of life.

Some small changes can make a world of difference to our disposable income which means there’s then more scope to commit money to pay off debt.

The key to doing this is to create a financial strategy that will free up some of your income that you can then commit to eradicating your debt.

Here are some actionable tips:-

- Create a budget whereby you assign each dollar of your income to each expense that you have and do not exceed that amount

- Practice the debt snowball method whereby you pay off your smallest debts first and foremost by throwing as much cash at those smaller debts as possible. The idea is this will give you the impetus to carry on paying off all of your debts as you’ll garner encouragement from each debt you discharge

- Make use of budgeting apps like Goodbudget and coupon/discount apps like Rakuten

Have a look at some practical steps you can take to help you save up to $5000 a year and more.

#3 Speak to Your Lenders and Get a Better Deal

A lot of lenders are prepared to offer a helping hand if you fall behind on your repayments.

To a lender, it is obviously much better to receive back some of the debt, or receive it back over a longer time period, than it is to apply so much pressure that you file for bankruptcy and your debt is discharged and they potentially see nothing.

This means that your lender will often agree to a settlement deal or will negotiate with you.

Here are some suggestions that you might want to discuss with your lender if you’re struggling with your repayments:-

- Ask your lender for lower monthly payments spread over a longer repayment period. This will help to alleviate any immediate financial pressure you’re under;

- Ask for a lower interest rate on the basis that you pay back the debt sooner;

- Ask your lender to create a repayment plan with you if you are temporarily unable to meet the debt. This can help delay your payments and give you some breathing space;

- Consider loan consolidation whereby you consolidate your debts, which can allow you to lower your monthly repayments and fix your interest rates;

- Offer a one time payment. Some lenders will accept a lump sum payment for less than the amount borrowed, especially if you are close to bankruptcy.

Note:

When negotiating with your lender, make sure you explain your situation fully and ask to speak to management if you feel like you’re not getting anywhere. Ask to make a recording of the agreement you reach and/or ask for it in writing.

#4 Reduce Your Credit Utilization

We have previously covered how your credit utilization makes up a huge chunk of your credit score.

At 30%, it’s only slightly less important than your payment history (35%).

To quickly recap; your credit utilization is the amount of credit you have used compared to the amount of credit you have available (your credit limit).

If you have a credit card limit of $50,000 and you have used $40,000 of that, then your credit utilization would be 80% for that card.

If you have multiple credit cards then simply add up all the credit limits of those cards ($100,000 in the below example) and then add up the total credit you have used ($75,000 in the below example). You can then work out your total credit utilization percentage as follows:-

How to Calculate Your Total Credit Utilization:

Total credit utilized $75,000 / $100,000 total credit limit x 100 = 75% credit utilization

The key is to try and keep your credit utilization below 30%.

The reason this is important is that lenders see you as a more responsible borrower and a less risky prospect if you’re not maxing out your credit cards. In turn, this is reflected in your credit score.

If you are living on the edge when it comes to your credit, then it can suggest to a lender that you are struggling and are close to delinquency.

Unfortunately, there are rarely any quick wins when it comes to credit repair as it can take some time.

However, improving your credit utilization is one of the best weapons at your disposal as making changes here can bring about big results in a short time frame.

Here are some tips on how you can reduce your credit utilization:-

- Reduce your spending. By doing this you are paying off your debt without allowing any further debt to build up. Your credit card utilization will therefore naturally reduce. Managing to do this has a lot to do with budgeting and making proper use of your income so that there is no need to use credit cards. Improve your spending, budgeting and saving habits and you’ll find extra cash that can be used for purchases you would normally put on your credit card.

- Increase your credit limit. If you have a good relationship with your credit card provider, they may be willing to increase your credit limit which will again naturally mean your credit utilization will reduce. This doesn’t mean you then start spending more just because you have a higher limit as this will take you back to square one. It should be used as a tactic to reduce your credit utilization and nothing more. Make sure to ask your creditor whether increasing the same will result in a hard inquiry which, as above, can reduce your credit score.

- Get a new credit card. This is another hack similar to increasing your credit limit. Again, it works by increasing your credit limit which will in turn bring down your credit utilization. The same caveats apply in that you should avoid the temptation to use up this credit just because it’s available. As we have said, this will just increase your utilization even more.

- Make smaller credit card payments. If each month you are spending $2000 on a credit card with a $4000 limit, even if you’re paying off $2000 of that debt each month, your utilization is still 50% (way above the recommended 30%). By making smaller payments each time your credit card balance reaches, say, $500 then your credit utilization will be much lower as you’re keeping your balance lower when compared to your credit limit.

- Keep accounts open. It can be a mistake to close credit accounts as this will likely reduce your overall credit limit, meaning that you will have a larger ratio of credit utilized to your overall credit limit. As we know, this is what increases your credit utilization figure and is what you want to avoid.

#5 Rebuild Your Credit Score With New Credit

Our fifth tip to repair your credit score is ideal for those who have a poor or very poor credit score and are looking to bring their score back from the brink.

Perhaps your credit history is so poor that you’re really struggling to find a lender to borrow from or perhaps you’ve been bankrupt or have come close.

The following things can help you rebuild the foundations of your credit score so you can get back into the green and become a less risky proposition for any would be lender.

Get a Secured Credit Card

Secured credit cards can be a lifesaver if you’ve been turned down for credit by other providers.

A secured credit card is one where you have to put money down initially as security.

The deposit you put down acts as collateral on your account in case you are unable to make the repayments.

Secured credit cards are great for people who have a very poor credit score as they can help re-establish your credit history even if it’s in the gutter.

The deposit you make to secure the card is usually equal to the credit limit on the card.

You will usually be expected to deposit around $200 with a credit limit equal to that.

Your line of credit will be limited compared to an unsecured card but this is still an excellent way to boost your credit score and should be seen as a tool to do just that.

Better still, if you keep your account in good health then your lender may allow you to change your credit card to an unsecured one and increase your credit limit after a period of time.

Get Help From Friends or Family

Co-Signer

A co-signer is someone with a good credit history who guarantees your credit card balance should you default on your repayments.

This means that even if you have poor credit you can still get accepted by many lenders as the money you are borrowing is secured by the co-signer.

Usually, a co-signer will be someone like a parent, another relative, or a close friend.

This is a great way to build up your credit history as you are able to piggyback off your co-signer’s good credit history and get credit with reasonable interest rates and a good repayment plan.

Authorized User

Another way to piggyback off someone else’s good credit history is to ask to join their credit account as an authorized user.

Some credit card companies will allow additional users to be added which means you can use the main user’s credit card and help rebuild your own credit history this way.

Note:

It’s important to check with the credit card company in question that they report you as an authorized user to the bureaus so you’re not simply improving the main user’s score. Obviously that would be pointless and would do nothing for your own credit score.

Use a Credit Builder Loan

Another tool at your disposal if you have a poor credit score is a credit builder loan.

Credit builder loans can be secured from community banks and credit unions and do not require you to have a certain credit score before you qualify for one.

However, they do require that you have the means to pay back the loan.

A credit builder loan is a loan whereby the money is usually held at the bank and you are unable to access the same until you have repaid the entire balance.

In this way, it acts as a kind of savings account but the neat part is your repayment activity is reported to the bureaus so it allows you to build up your credit score at the same time.

In that sense, credit-builder loans can be a safe and secure way of rebuilding your credit.

Get a Store Card

Using a store credit card can be a great way to rebuild your credit score.

Store cards can often be easier to qualify for than regular credit cards so they are a good place to start if you cannot secure a standard credit card or you don’t want to pay for a secured credit card.

Store cards will often have higher interest rates and smaller credit limits but the key is to simply use them as a means to boost your credit score and not to rely on them as your main payment method.

#6 Instruct a Credit Repair Company

If you have the money, you could also try instructing a credit repair company.

They will look at your credit report and dispute any items on there.

They can also help you with repayment plans, how to manage your credit utilization and how to devise a plan to get your back in the green.

We covered our favorite credit repair companies in a previous article.

Conclusion

Repairing your credit score can take time and a good dose of effort on your part but the key thing to remember is that it can be done and there are actionable steps you can start taking today to improve your credit health.

Improving your credit score can make your financial life much easier and cheaper in the long run.

With an improved credit score, you’ll be able to secure better interest rates and have many more options available to you when it comes to opening lines of credit.

Therefore, trying to improve your credit score is always a worthwhile endeavor even if it can seem daunting at first.

In summary, after reading this guide hopefully, you now understand:

- What having bad and good credit means for you

- What a credit score is and how it is calculated

- How to find and understand your credit score

- How to get your credit report and understand what’s on it

- How to improve your credit score by disputing any inaccuracies on your report, improving your repayment and credit card utilization and by using new credit.